#GGC2020 CASE COMPANIES

MARITIME RESOURCES

Two years of exploration and project de-risking have set the stage for a re-start of the high grade Hammerdown gold mine plus potential for additional gold resources at the Whisker Valley Project.

- Former Hammerdown gold mine, operated by Richmont Mines with a cut-off grade of 8.2 gpt and a head grade of 15.7 gpt during the early 2000’s

- Newfoundland & Labrador ranked one of the top jurisdictions for mining

- NI 43-101 mineral resource of 521 k oz @ 5.64 gpt Au Measured & Indicated plus 466k oz @ 4.49 gpt Inferred

- 2020 Hammerdown PEA -$204M NPV/81% IRR after-tax @ US$1,650/oz with an average of 70,000 oz per year in the fist 5 years of production

- Exploration upside along the 5 km Hammerdown trend and nearby Whisker Valley gold-rich VMS project

- Well funded with $7.6 M in working capital. Major shareholders include Dundee Goodman Merchant Partners, Sprott and 1832 Asset Management

LUNDIN GOLD

Lundin Gold is headquartered in Vancouver, Canada, with a corporate office in Quito, Ecuador. The Company owns the Fruta del Norte gold mine in southeast Ecuador.

Fruta del Norte is one of the few multi-million-ounce, high grade gold assets in production, having reached commercial production in February 2020, ahead of schedule. The Company’s board and management team have extensive expertise in mine operations and are dedicated to reaching name plate capacity at Fruta del Norte and growing the current resource through exploration. Lundin Gold will also look to grow the company through accretive transactions.

MARATHON GOLD

Marathon (TSX:MOZ) is a Toronto-based gold company advancing its 100%-owned Valentine Gold Project located in the Central Region of Newfoundland and Labrador, one of the top mining jurisdictions in the world. The Project comprises a series of four mineralized deposits along a 20-kilometre system. Once developed, the Valentine Gold Project will be the largest gold mine in Atlantic Canada.

THANK YOU TO ALL OF OUR #GGC2020 SPONSORS!

#GGC2020 TEAMS

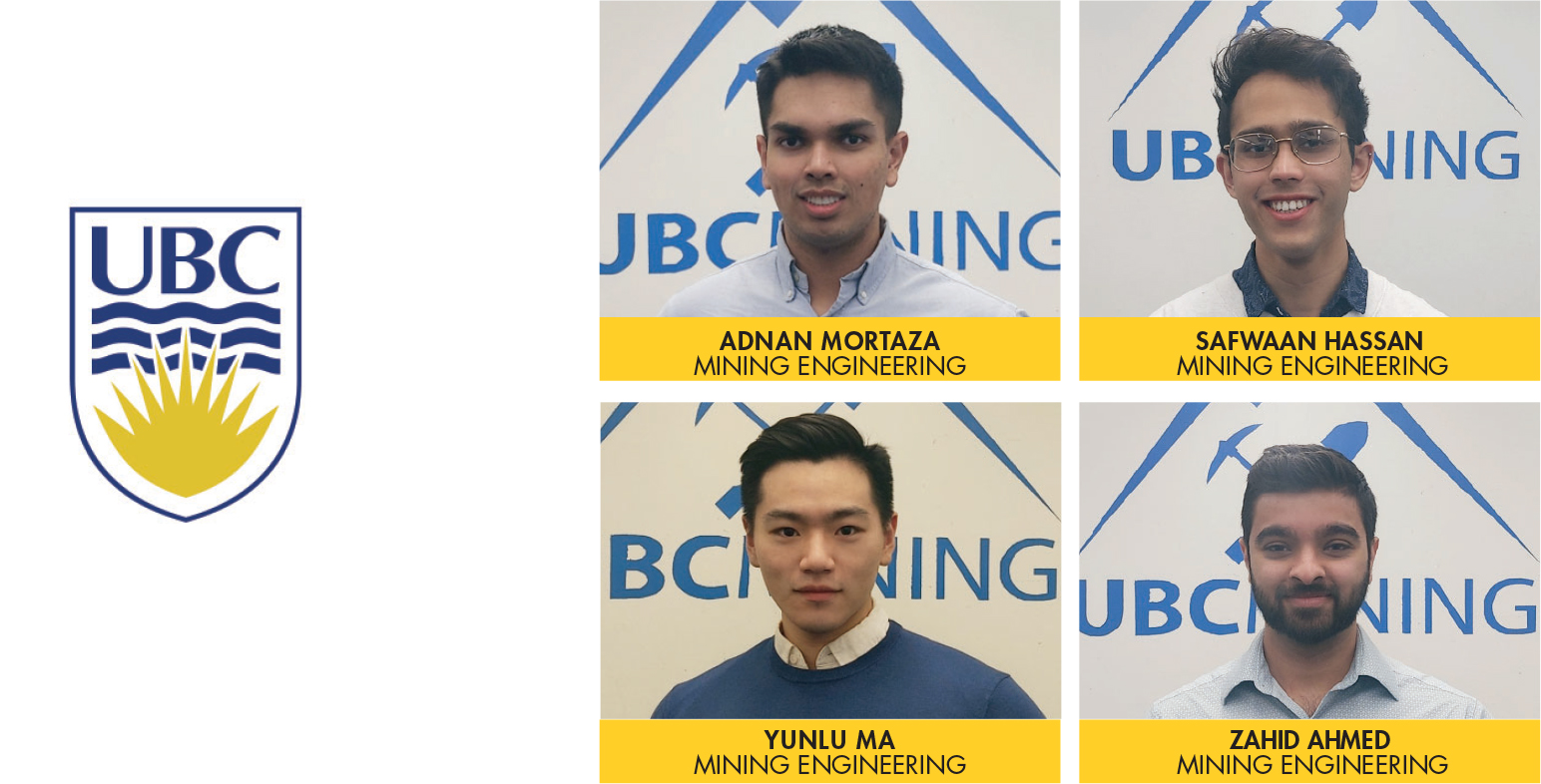

#GGC2020 WINNERS

CONGRATULATIONS

The University of British Columbia was declared the winner at the 2020 Goodman Gold Challenge on February 8th!

The team beat out rival squads from McGill University and the University of Manitoba to take home the win by providing an in-depth analysis of Marathan Gold’s Valentine Gold Project!

They went home with the top prize, the cash equivalent of four ounces of gold!